Stick sushi财务报告分析

TOWS ANALYSIS Strengths: Local director and operation management worked for a global restaurants; Have their own supply chain; Internal training programme can promote more qualified chefs and keep the food in the same quality at reasonable price. 全球餐厅当地的导演和运行管理工作; 有自己的供应链; 内部培训计划可以促进更多合格的厨师和食品保持在同一质量,合理的价格 Weakness: Training programme is only in Denmark and trained chefs and management seldom exchange to UK restaurant; Own supply chain is easy to lay off (Not often but threaten the sales once happened); 只有在丹麦和训练有素的厨师和管理的培训方案是很少交流,以英国餐馆;自己的供应链很容易解雇(不是经常,但威胁的销售曾经发生过); Opportunities: The UK restaurants industry is forecast to have a high growth in future years; SO Experienced local management is good for future expansion of business; Own supplier chain can keep taste of food and lower costs of raw material; Internal training programme is useful to keep the same quality. 经验丰富的本地管理有利于未来业务扩张;自己的供应链可以保持食物的味道和低成本的原料;内部培训方案有助于保持相同的质量 OW Exchange or sent trained chefs and management to UK in order to improve local sales and expansion of “ the concept”;Improve supply chain, reduce lay off . 交换或训练厨师和管理发送到英国,以提高本地销售和扩张"概念";改善供应链,减少裁员 Threats: 1. High restaurant regulations 2. High restaurant competition. 3. High consumer switching. 3. 高餐厅规定. 4. 高餐馆竞争 5. 高消费者切换 ST Local management know regulations and problem of consumer switching very well to help improve service to face high competition; Own supplier chain will keep the quality of raw material and lower costs; And the same quality with a reasonable price can lower consumer switching. 当地的管理条例和消费者很好的切换问题,以帮助改善面临高竞争的服务; 自己的供应链将使原材料质量,降低成本; 同等质量,价格合理可以降低消费者的切换 WT Improve training programme to keep and attract more customers; Build strong supplier communication in order to avoid lay off and poor quality of food. 提高培训计划,保持和吸引更多的顾客; 建立强有力的供应商沟通,以避免裁员,质量差的食物。 Strengths Experience since 1994; Innovate-First movers Focus is on providing bite-size delicacies They own a professional business Training programme Weaknesses Less communication between UK and DK; Inefficient internal training programme; Narrow range menu Opportunities London is the largest city in the UK; London is and will remain the eating out capital; GDP in London maintains consumer confidence and limit the impact on the food service market. The most thrilling food service markets Threats Competition is too high; Fast food such as McDonald’s, Pizza Hut, KFC and so on are leading multinational chain present in the capital and other major UK cities. Sushi Restaurants in UK have a wide range menu.

1. The Operation Capability

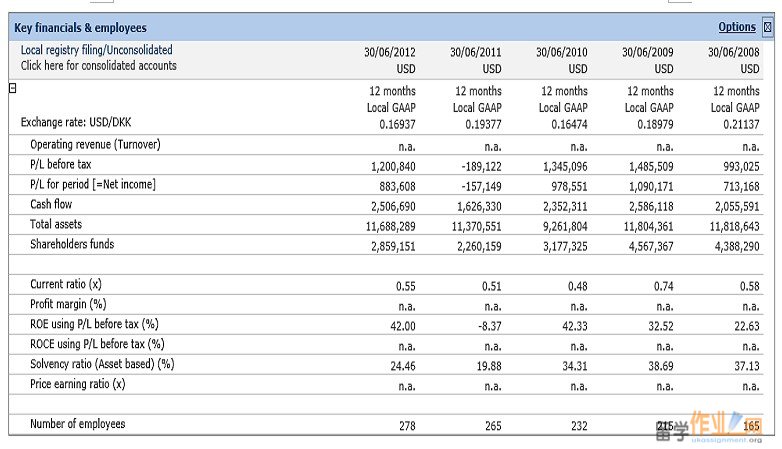

According to the widely adopted Dupont analysis method, one of the most important indicators to measure the and evaluate the operation capability of a company is the ROE (Return on Equity). When we look at the ROE of the company, the indicator keeps at a positive and relatively high level around 40% from year 2008~2010 and in the year of 2012. However, in the year of 2011, the ROE is negative. On the other hand, the shareholder funds in that year are increased comparing to the years before. We can easily deduct that the profit in that year suffers from a dramatic decline. The reason behind it could be quite diversified. However, we notice that the employee number increased by a large number at 2011 comparing to the years before. It is likely the labor cost and the expense of training on the new coming staff take out quite a lot of profit. The investment on human resource should be cherished for its value contributing the long-term development of company. As what we expect, the ROE returns to normal at 2012, one year after 2011. We can conclude that the company owns a relatively strong and smooth operation capability but weak risk control ability.

2. The capital can be used for investment

The capital can be used for investment is the total asset takes out the liabilities (total asset*solvency ratio) and shareholder funds. By using the solvency ratio, we can obtain the capital can be used for investment in 2012 is $5,970,182. The variable in 2011,2010,2009,2008 is $6,849,926, $2,906,754, $2,669,886, $3,042,090. The figure is ascending in the recent year. We can conclude the risk resistance capability is smoothly increasing.

15012858052

15012858052

153688106

153688106