Overview: Planning for Retirement

Annuities are a common type of retirement product. Retirees can purchase an annuity which guarantees payment of a fixed amount on a regular basis which can be used to provide income during retirement. 年金是一种常见类型的退休产品。退休人员可以购买年金,保证可以用来提供退休收入在定期支付固定金额。

根据所提供的资料,您将需要计算:(一)总储蓄,你会为了买一个退休年金及(ii)所需的每月储蓄积累必要购买金额需要积累您的退休日期退休年金。

Based on the information provided, you will need to calculate: (i)the total savings you will need to accumulate by your retirement date in order to buy a retirement annuity and (ii) the monthly savings required to accumulate the amount necessary to purchase the retirement annuity.

Information to be used in your calculations:在您的计算中要使用的信息:

1。工作年限数,在此期间,你会为退休储蓄:25岁

2。已经保存的时候,你开始你的工作生涯退休金额:$ 2,000

3。收到大笔的遗产15岁,退休前被添加到您的退休储蓄:$ 20,000

4。赚取利率储蓄年利率9.5%,每月复利。

5。数年退休年金将提供相等于每年付款给你:40岁

6。年度年金给付:$ 100,000

7。使用年金提供商的利率来计算,每年的年金支付的成本(现值):5.5 PA,每年复利。

1. Number of working years during which you will save for retirement: 25 years

2. Amount already saved for retirement at the time you begin your working career: $2,000

3. Amount of inheritance received 15 years before retirement which is added to your retirement savings: $20,000

4. Interest rate earned on savings: 9.5% pa, compounding monthly.

5. Number of years for which retirement annuity will provide equal annual payments to you: 40 years

6. Annual annuity payment: $100,000

7. Interest rate used by annuity provider to calculate the cost (present value) of the annual annuity payments: 5.5 pa, compounding annually.

A. Required Savings[4 marks]

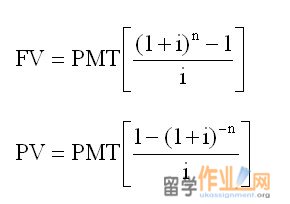

You should use the information provided above to calculate the cost of the annuity product. This is the total amount of savings you will need to accumulate by your retirement date in order to buy the annuity. You must show the correct formula with the correct numbers in the formula.

B. Annual SavingsDuring Working Life[7 marks]

Use the information on the savings already accumulated at the start of your working life and your inheritance to calculate the equal monthly savings you will need to make in order to accumulate the amount required to buy the annuity product when you retire. You must show the correct formulas with the correct numbers in the formulas. [Drawing a timeline will help you to organise the information and to select the appropriate formulas]. [6 marks]

Comment on whether you believe your planned monthly savings are affordable, giving reasons for your answer. [1 mark]

Using Formulas in Your Presentation:

When using an annuity formula in your report you can copy the formula from the list at the end of this document and paste it into your Word document. To insert the relevant numbers click on the formula with the right hand mouse button and select “Equation Object” and then “Edit”. You can then highlight the relevant item (e.g., FV or PMT) and type in the actual value. When you have finished editing press “ESC” twice. Please contact your tutor if you experience difficulties.

C. Risks[4 marks]

Because life includes many uncertainties you should also identify and discuss two risks faced by youin successfully financing your retirement. For each risk you should: (a) provide an illustration of how it could change your calculations; and (b) suggest actions that you might take to address the risk. Remember that risk is the possibility of something unexpected happening – which could include either positive or negative surprises.

D. Presentation of Report[4 marks]

Your report must have a cover sheet with your name, student ID, name of your tutor, time and day of your tutorial, and title of the report – including assignment number (A, B, C or D). You should also have section headings, including an introduction and conclusions, and page numbers. You do not need to submit your report to Turnitin, but evidence of copying material from other students could lead to loss of marks and charges of academic misconduct.

Due Date: Your report is due to be emailed to your tutor by no later than 5 pm on Friday, 8 November or it can be handed to your tutor in your tutorial of Week 5. Students must work individually. Do not copy from other students as this will be checked.

Marking Guide:

Calculations: Full marks will be awarded for correct calculations, including formulas with correct numbers in them; ½ mark subtracted for each mistake (e.g., wrong number of years); 1 mark subtracted if incorrect formula used (e.g., using FV instead of PV formula or compound interest formula instead of annuity formula) and no marks awarded if formulas not provided. One mark for a meaningful answer on the affordability of the monthly savings.

Risks: 1 markwill be awarded for identifying each meaningful risk. 1/2 markwill be awarded for explaining the impact of each identified risk on your retirement plans and 1/2 mark for suggesting appropriate actions to address the risk. No marks awarded if the risk identified is not relevant to the case study.

Presentation: Full marks will be awarded for a well presented report with student name and ID, tutor name and tutorial time, title of report – including Assignment number (A, B, C or D), section headings, and page numbers; and minimal grammatical or spelling errors. All dollar amounts should be shown correct to 2 decimal places. Marks will be deducted for reports missing any of these presentational requirements. Zero marks will be awarded if no effort has been made to organise the presentation of the findings as a formal report. Accuracy and completeness of calculations are not factored into presentation marks.

Formulas:

FV = PV(1 + i)n

PV = FV(1 + i)-n

15012858052

15012858052

153688106

153688106