What is shareholder wealth?

股东的财富是什么?

• Maximising wealth can be defined as maximising purchasing power.

• 最大化的财富可以被定义为最大限度地提高购买力。

• Maximising shareholder wealth means maximising the flow of dividends to shareholders through time.

• 股东财富最大化是指通过时间的流量最大化的股息予股东。

Profit maximisation is not the same as shareholder wealth maximisation

利润最大化和股东财富最大化是不一样的

• Prospects展望

• Risk风险

• Accounting problems会计问题

• Communication通讯

• Additional capital附加资本

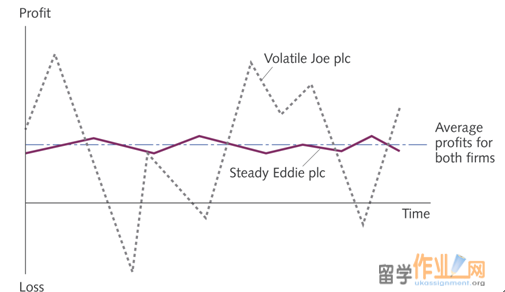

Exhibit 1.8 Two firms with identical average profits but different risk levels

图表1.8两家公司具有相同的平均利润,但风险水平不同

Ownership and control

所有权和控制权

http://www.ukassignment.org/azdxassignment/

• The problem问题

– Diffuse and fragmented set of shareholders

– 股东零散并不成系统

– Control often lies in the hands of directors

– 控制往往在于董事之手

– Separation, or a divorce, of ownership and control

– 分开,或分离,所有权和控制权

– The management team may pursue objectives attractive to them

– 管理团队可能会吸引他们追求的目标

– ‘Managerialism’ or ‘managementism’

– “管理主义”

– An example of the principal–agent problem

– 委托 - 代理问题的一个例子

• Agency costs

• 代理成本

– (a) Monitor managers’ behaviour

– 监视经理人行为

– (b) Create incentive schemes and controls for managers to encourage the pursuit of shareholders’ wealth maximisation

– 建立激励机制和控制管理者鼓励追求股东财富最大化

– Agency cost of the loss of wealth caused by the extent to which prevention measures do not work

– 代理成本,财富的损失引起的预防措施,在何种程度上不工作

• Aligning the actions of senior management with the interests of shareholders ‘goal congruence’

• 对齐操作的高级管理人员与股东目标一致的利益'

• Some solutions

• 一些解决方案

– Linking rewards to shareholder wealth improvements

– 将奖励提高股东财富

– Sackings

– 人人自危

– Selling shares and the takeover threat

– 销售股份及收购的威胁

– Corporate governance regulations

– 企业管治法规

– Information flow

– 信息流

Lecture review 1

讲座回顾1

• Firms should clearly define the objective of the enterprise to provide a focus for decision making.

• 企业应明确定义的目标,为企业提供决策的重点。

• Sound financial management is necessary for the achievement of all stakeholder goals.

• 健全的财务管理,实现所有利益相关者的目标是必要的。

• Some stakeholders will have their returns satisficed, others maximised.

• 一些利益相关者将他们的回报令人满意的,其他人最大化。

• Assumed objective of the firm for finance is to maximise shareholder wealth.

• 假定金融公司的目标是股东财富最大化。

– Practical实用

– The contractual theory契约理论

– Survival生存

– Better for society更好地为社会

– Counters the tendency of managers to pursue goals for their own benefit

– 计数器管理者追求的目标,为自己的利益的倾向

– They own the firm他们拥有公司

• Maximising shareholder wealth is maximising purchasing power or maximising the flow of discounted cash flow to shareholders over a long time horizon.

• 最大化股东财富最大化购买力或最大限度地提高股东现金流贴现,过了很长的时间跨度的流动。

Lecture review 2

讲座回顾2

Profit maximisation: different from shareholder wealth maximisation

• 利润最大化:从股东财富最大化不同

– Future prospects未来前景

– Risk风险

– Survival生存

– Accounting problems会计问题

– Communication通信

– Additional capital额外资金

• Separation of ownership and control

• 所有权和控制权的分离

• Managerialism管理主义

• Principal–agent problem:

• 委托代理问题:

– Some solutions: 一些解决方案

– Link managerial rewards to shareholder wealth improvement提高股东财富管理回报链接

– Sackings人人自危

– Selling shares and the takeover threat销售股份及收购的威胁

– Corporate governance regulation公司治理监管

– Improve information flow提高信息流

15012858052

15012858052

153688106

153688106